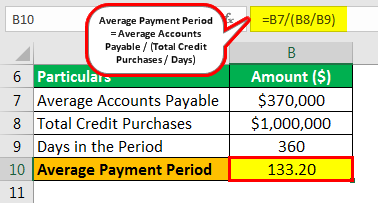

To evaluate the effectiveness of this assortment interval, corporations often interact in benchmarking against competitors or industry standards. A decrease average collection period definition average collection period is indicative of efficient credit administration and cash flow practices, while a better interval might recommend potential issues in amassing receivables. A high average collection period signals that a company is having points amassing funds from its clients at a timely price. This can have a dangerous impression on money move and a company’s total income and profitability. Slow cost collections signal that a company’s accounts receivable collections course of is inefficient and has room for improvement. Conversely, an extended ACP indicates that the corporate ought to tighten its credit score coverage and enhance the management of accounts receivable to have the ability to meet its short-term obligations.

A Information To Allowance For Doubtful Accounts: Definition, Examples, And Calculation Methods

- In this case, the purchasers of XYZ take more than two months to repay the sale quantity.

- A longer assortment interval may indicate lax collection efforts, inefficient collections procedures, or poorly educated staff.

- The company has a decent credit score coverage as a result of it plans to pay off its short debt by the tip of the fiscal year.

This strategy can scale back the typical collection interval, however it may additionally scale back the total amount you collect, so it is vital to contemplate the overall influence https://www.kelleysbookkeeping.com/ on profitability. Lastly, providing incentives for prompt funds could inspire your clients to pay their payments faster, thus lowering the average assortment period. A longer assortment interval may indicate financial distress, because it may mean prospects are struggling to pay their payments, or the company just isn’t enforcing its collection phrases strictly enough. Consequently, it represents a higher diploma of credit threat, which may deter potential investors and lenders. As Soon As a credit score sale happens, the purchasers get a specific time limit to make the cost. Each firm monitors this era and tries to maintain it as quick as possible in order that the receivables do not remain blocked for an extended time.

Recognizing Potential Drawbacks

Average collection interval is the amount of time required for a business to receive funds from clients. It could be regarded as the time that elapses between the date that a credit score sale is made and the date that the complete amount is collected from the shopper. A shorter average assortment interval is considered more favorably than a longer one, as this signals that a property collects funds quicker. In conclusion, the typical collection interval plays a vital role in determining an organization’s financial well being.

What Factors Can Affect The Average Collection Period?

Average Assortment Period is an important metric that offers perception into your company’s capacity to convert credit score sales into cash, impacting every little thing from liquidity to credit score coverage. By aggressively pursuing collections, businesses may strain their relationships with prospects. If customers perceive the firm’s assortment practices as overly harsh or inflexible, it may result in buyer dissatisfaction, damaging the company’s status.

You must calculate the common accounts receivable and discover out the accounts receivables turnover ratio. An increase within the receivables collection period is often a trigger for concern, as it suggests potential points within the cash circulate cycle. For occasion, a company might experience the next variety of prospects with delayed fee patterns, indicating potential credit dangers. Additionally, modifications in financial situations or industry dynamics can influence customer cost behaviour, resulting in extended assortment durations. By monitoring this era, businesses can assess their ability to convert credit sales into cash and manage their cash circulate successfully.

If the typical accounts receivable measurement is $10,000 for a month, then it’s an even speed of 12. It implies that it takes a few month or 30 days (365/12) to receive the cash from the sales made on credit. The quantity ‘12’ here is the ratio, while the ’30 days’ half is the typical collection period. A firm’s assortment interval tells investors how efficiently the corporate is utilizing its assets. Corporations that may quickly collect from clients display their adeptness at managing their accounts receivable, demonstrating excessive levels of economic effectivity. When a company has a shorter collection period, it reveals that it’s able to convert its gross sales into actual cash more quickly.